If you are looking for a way to reduce your tax bill and make a meaningful donation to ERBF, consider a donation of publicly traded securities. This is an efficient way to give charitably, and the benefits are that you save more and you give more.

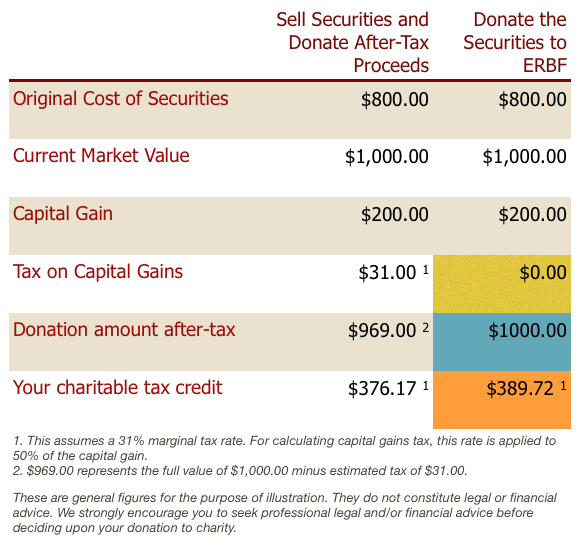

When you donate a publicly traded security directly to the church, the Canada Revenue Agency does not apply capital gains tax on the donation. Normally, when you sell your shares for cash, you're responsible for the tax due on the capital gain (the increase in the value of your securities over the price you paid at purchase), even if you plan to donate the proceeds from the sale of the security to the church. If you pay the tax out of the proceeds, the amount you have to donate to the church is less. Then you have a smaller donation to claim for a charitable tax credit at the end of the year. By donating directly from your brokerage account to the church's, the inclusion rate of zero applies to any capital gain realized on the exchange of the publicly traded security.

After receiving the transfer of the publicly traded security into the church's RBC brokerage account, ERBF will then sell the security within our account and the cash proceeds will be used for ERBF church operations.

Eligible publicly traded security types are as follows:

- shares, debt obligations or rights listed on a designated stock exchange

- shares of capital stock of a mutual fund corporation

- units of a mutual fund trust

- interest in related segregated fund trusts

- prescibed debt obligations

Here is a simple example:

For more information, please contact our church office at (604) 464-2416.